Were your guesses close?

Over the last 86 years |

Your Guess |

Actual* |

Probability* |

|

BIG LOSS 12% or more |

years |

6 years | 7% |

|

Small Loss 0% to -11.9% |

years |

15 years | 17.4% |

|

Small Gain 0.1% to 11.9% |

years |

19 years | 22.1% |

|

BIG GAIN 12% or more |

years |

46 years | 53.5% |

*Based on 2022 S&P 500 Index data. An investment cannot be made directly into an index.

Do your guesses match the reality of the data? If not, seeing the differences quantified may help you realize how misconceptions about stock market realities can affect your investment decision-making.

If you allow your emotions to guide your investment strategy, just one behavioral failure could significantly alter your path to a secure retirement.

Hopefully, taking this quiz will empower you with greater self-awareness and help you persevere and make more informed decisions when markets get choppy.

Keep scrolling for an interesting historical snapshot of market returns since 1937.

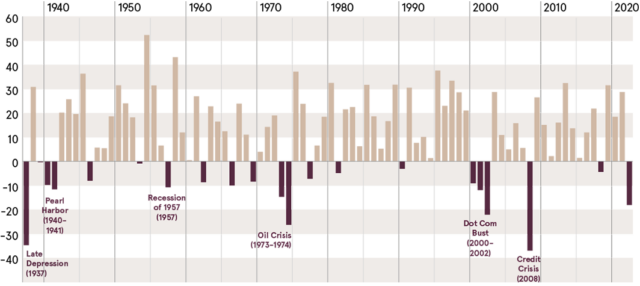

A snapshot of market growth and loss from 1937 to 2022

As you can see, the market tends to fluctuate, but historically, there have been more years of growth than years of loss.

S&P 500 Index1

S&P 500 Index as of 12/31/2022. Chart is for illustrative purposes only and is not representative of the performance of any particular portfolio, security, or strategy. An investment cannot be made directly in an index. Past performance is no guarantee of future results.

Emotions often cloud investor judgment, so being armed with facts means having more confidence in your choices. In the end, this can have a positive effect on your investment portfolio and your future.